What You Need To Know About Pre-Approval

Some Highlights

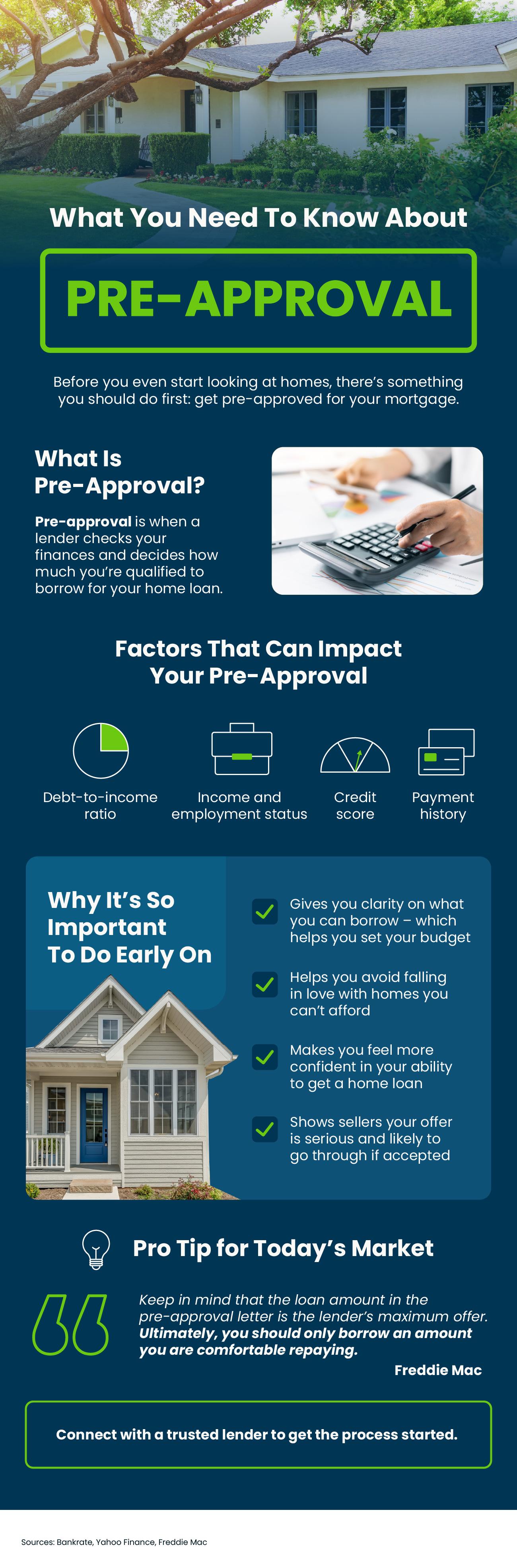

- Before you even start looking at homes, there’s something you should do first – and that’s get pre-approved for your mortgage.

- Pre-approval is when a lender checks your finances and decides how much you’re qualified to borrow for your home loan. This helps you determine your budget and makes your offer stand out for sellers.

- Connect with a trusted lender to get the process started.

Categories

Recent Posts

More Buyers Are Planning To Move in 2026. Here’s How To Get Ready.

Not Sure If You’re Ready To Buy a Home? Ask Yourself These 5 Questions.

Reasons To Be Optimistic About the 2026 Housing Market

Turning a House Into a Home: The Benefits You Can Actually Feel

Your House Didn’t Sell. What Now?

Headlines Have You Worried about Your Home’s Value? Read This.

Is January the Best Time To Buy a Home?

Is Buyer Demand Picking Back Up? What Sellers Should Know.

How To Stretch Your Options, Not Your Budget

Your Equity Could Change Everything About Your Next Move

Corinne Schippert

Real Estate Agent | License ID: 9555016

+1(781) 710-6804 | corinneschippert.realtor@gmail.com